Taaleri’s business model

Taaleri’s vision is to become a leading investment manager operating internationally in bioindustry and renewable energy. Through our private equity funds and investments, we create, for example, wind and solar power, bio-based products that replace fossil resources, and affordable and energy-efficient rental homes.

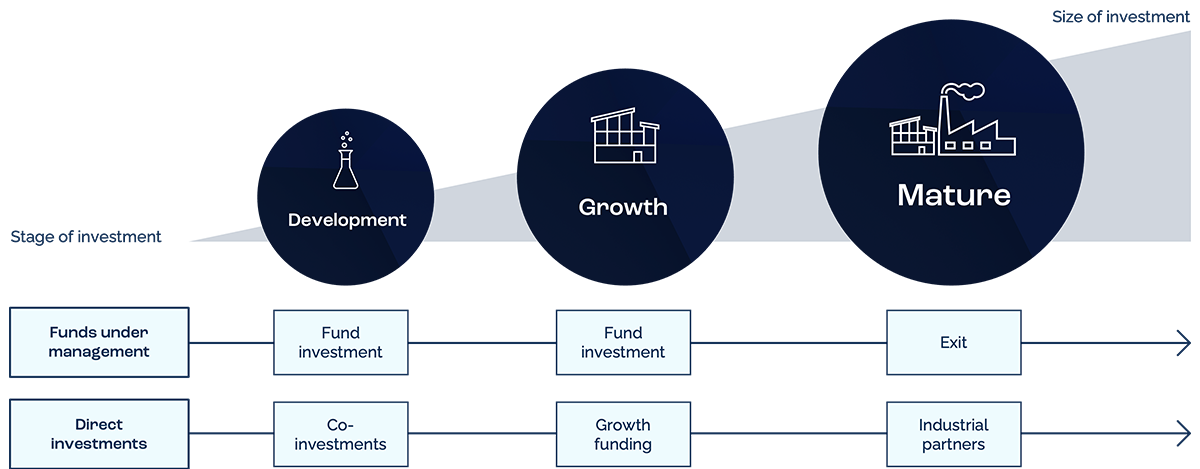

We make investments both through our private equity funds and through direct investments from our own balance sheet.

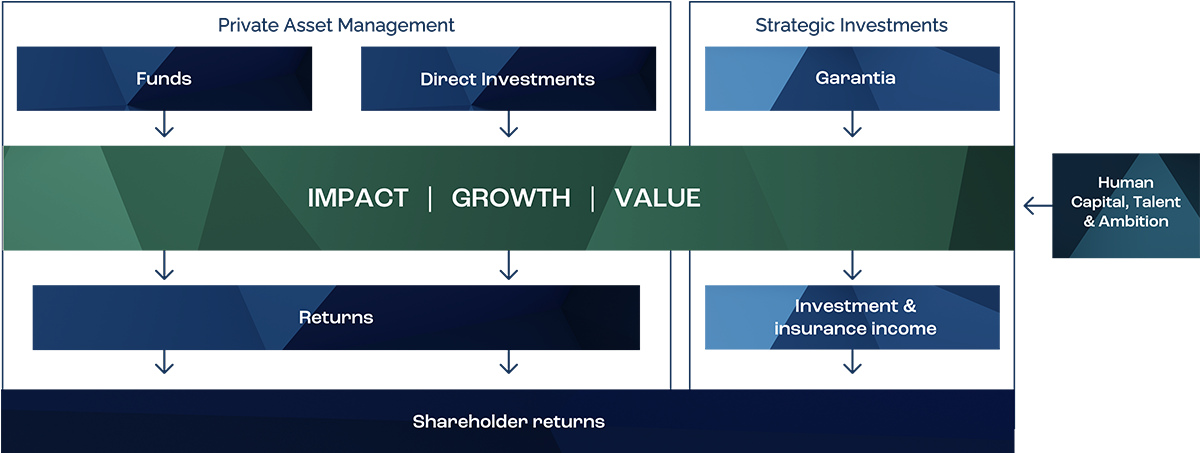

Taaleri’s business consists of two reporting business segments: Private Asset Management and Strategic Investments. The Private Asset Management segment includes bioindustry, renewable energy and real estate businesses. The Strategic Investments segment includes Garantia Insurance Company Ltd. In addition, the Other group is used to present the Group’s non-strategic investments, Taaleri Kapitaali and Group operations not included in the business segments.

Private Asset Management

Taaleri’s private equity funds business focuses on renewable energy, real estate and bioindustry. Among our businesses, renewable energy has progressed to a stage where we will achieve benefits of scale with the next private equity fund, Taaleri SolarWind III. In the real estate and bioindustry businesses, we focus on the development and ramp-up of operations. With all new funds, we promote sustainable development, that is, we have defined sustainability targets for them, the fulfilment of which we measure and on which we report to the investors of the funds.

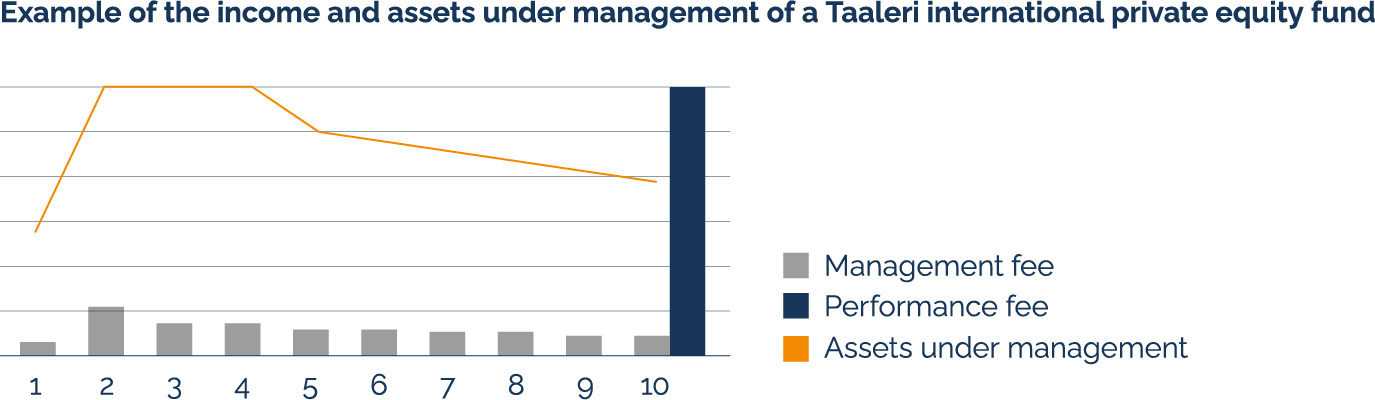

Different funds have slightly different earning models, which consist of management fees and performance fees. Typically, the fund’s performance fee is realised in full or to a large extent in connection with the fund exit (see figure below).

In new private equity funds, the management fee is usually earned for the first years based on the amount of the fund’s investment commitments and, after the investment period, on the investment assets under management. Exits carried out after the fund’s investment period reduce the assets under management. Where a fund exceeds its targets, it may distribute performance fee in accordance with the fund’s rules. Taaleri assesses performance fees and their realisation every six months, at which time performance fees are recognised as income if the specified conditions are met. The final amount of the performance fee will be determined in connection with the exit of the fund or co-investment, at which point the performance fee will be paid.

Strategic Investments

Garantia Insurance Company, which belongs to the Strategic Investments segment, provides customers with easy and cost-effective guaranty solutions and new business opportunities through digital channels. The company's business is divided into guaranty insurance and investment operations. Through its guaranty insurance operations, Garantia helped facilitate approximately 14,000 new homes in Finland in 2022.

Garantia’s guaranty insurance business consists of consumer business and corporate business. The consumer exposures consist of residential mortgage guaranties and rent guarantees underwritten to private households. The residential mortgage guaranty is a supplementary collateral underwritten to cover a housing loan. The rent guarantee protects landlords against tenants defaulting on obligations specified in lease contracts. Most of the consumer exposure is made up of the residential mortgage guaranty portfolio. The corporate exposure is made up of corporate loan guarantees, commercial bonds, and other business-related guarantees. The guaranteed companies in the corporate portfolio mainly include medium and large Finnish companies and other organisations.

Garantia’s investment portfolio mostly consists of fixed-income investments, of which the majority was made up of investments in bonds of Nordic companies, credit institutions and insurance companies with strong creditworthiness. The fixed-income investments also include bond funds that invest in government debt securities. The investment portfolio also contains some equity and private equity investments as well as real estate investments.

The Strategic Investments segment also includes the shares in Aktia Bank Plc, which Taaleri received as part of the transaction amount as a result of the sale of the wealth management operations.